Futures trading is speculative, involves a high degree of risk and is not suitable for every investor. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

E Mini Futures Trading Alerts

A Subscription Service of The Market Analysts Group, LLC

Swing Trading Services since 2009 covering 3x ETF, Stocks, and Futures!

⚡ Dominate S&P 500 E-mini Futures with Clarity and Precision

Real-Time ES Alerts | Powered by Elliott Wave + Behavioral Pattern Analysis

Trusted by Traders for Years — Now on a New Platform

Our ES Futures Service was proudly featured as a Premium Room on Stocktwits from October 2018 to January 2024.

In 2025, we transitioned to our own platform on Memberful.com, delivering a more focused, streamlined experience for serious traders.

“ “I can personally attest to the value of the ES Futures Service. Not only are the trades excellent, but I was pleasantly surprised to learn about the tax advantages of trading futures. Good to know!”

— Cory S., ES Alerts Member since February 2024

📊 Our Strategy: Forecast Behavioral Patterns First. Trade with Precision.

At the core of our trading success is a proprietary, battle-tested forecasting method we call “The Market Map.” It blends Elliott Wave Theory, behavioral market psychology, fibonacci sequencing, and years of refined analysis to project short- and intermediate-term movements in the S&P 500 Futures (ES).

🔍 The Process

Forecast First:

Each morning, we publish an updated SPX market outlook with clear directional bias, target levels, and timeframe expectations. These updates are the result of a behavioral pattern model we’ve evolved since 2009, delivering consistently accurate market reads.Behavioral Precision:

Rather than relying on lagging indicators, we focus on contrarian sentiment shifts, pattern recognition, and psychological pivot zones—often identifying turning points before the crowd sees them.From Map to Trade:

Once the “map” is set, we scan for high-probability inflection zones. When price hits a forecasted pivot with confluence, we issue a real-time alert—complete with guidance, directional context, and trade management insights.

🧠 Why It Works

This strategy doesn’t follow the herd. It anticipates where the market is likely to go next, based on crowd behavior, wave structure, and momentum flow. The result?

More conviction. Fewer distractions. Better trades.

🎯 Trade the ES (SP 500 Futures) with a Behavioral Pattern System That Cuts Through the Noise

EsAlerts is a futures trading service built for serious S&P 500 E-mini (ES) traders who want a clear edge in today’s high-volatility market.

Our proprietary method blends Elliott Wave Theory with the Banister Behavioral Pattern System, using just a few powerful indicators to identify high-probability long and short setups.

No clutter. No second-guessing. Just direct, disciplined execution.

🔥 What Makes EsAlerts Different?

✅ Behavioral Pattern Triggers – Proprietary entry/exit signals based on trader psychology and wave structure

✅ Elliott Wave Roadmap – Know which stage of the move you’re in: Impulse, correction, exhaustion

✅ Simplicity That Works – A few select signals cut through the noise of typical technical analysis

✅ 7-Year Proven Track Record – Used successfully in live markets since 2017

📉 You’ll Know Exactly When to Act

No more confusion or screen-watching. Here’s what you get:

Real-Time Alerts when ES hits key behavioral setup zones along with morning guidance every day

Long or Short Trade Signals based on a limited number of high-conviction behavioral pattern indicators

Clear Trade Instructions: Entry range, stop zone, and directional thesis—no interpretation needed

Fresh Daily Pre-Market Report: Delivered each morning with updated ES charts, wave counts, and commentary so you’re ready before the bell

💬 What Members Say

“Hi Dave … I’ve used a number of advisory services, and **yours is by far the best**—both 3x ETF and ES Mini. I recommend it without reservation.

PS: I’m still planning on naming my next child after you!”

— Vincent Wong

ES Alerts & 3x ETF Member

“I picked up your **E-Mini system on Friday**… and by Monday I had paid for the monthly subscription **six times over**. I’m still in your latest trade and it’s working beautifully.”

— Barry Scott

“Thank you David for another great trade. With **/MES contracts**, I’m capturing early profits while **holding additional contracts to ride the trend**. I use your charts daily—**great job!**”

— Robert Tonkavich

🚀 Trade with Confidence, Not Clutter

EsAlerts is for ES traders who are tired of complex technical setups, lagging indicators, and mixed signals. Our system gives you:

✅ Wave-based direction with behavioral confirmation

✅ Simple, direct alerts—no guesswork

✅ Built-in discipline: Structured entries, exits, and trade plans

✅ Confidence to execute: Because the system has worked for over 7 years

🏁 Ready to Simplify and Strengthen Your ES Trading?

This isn’t another “signal service.” It’s a proven methodology designed to help you consistently navigate the S&P 500 E-mini with structure, psychology, and precision.

E Mini Futures Trading Advisory, Market forecast models, and Trade Alerts$59 a month to access Dave’s daily morning updates, Trade alerts, and SP 500 forecast models for guidance and more! Hosted on the Memberful.com platform along with our 3x ETF swing trade members.

STILL HAVE QUESTIONS OR NOT SURE HOW TO TRADE THE MICRO-MINI’S?

READ OUR FAQ PAGE AND TUTORIAL

EsAlerts – Behavioral. Structural. Profitable.

S&P 500 E-mini Futures trading without the noise.

Themarketanalysts.com (For more details on what we offer)

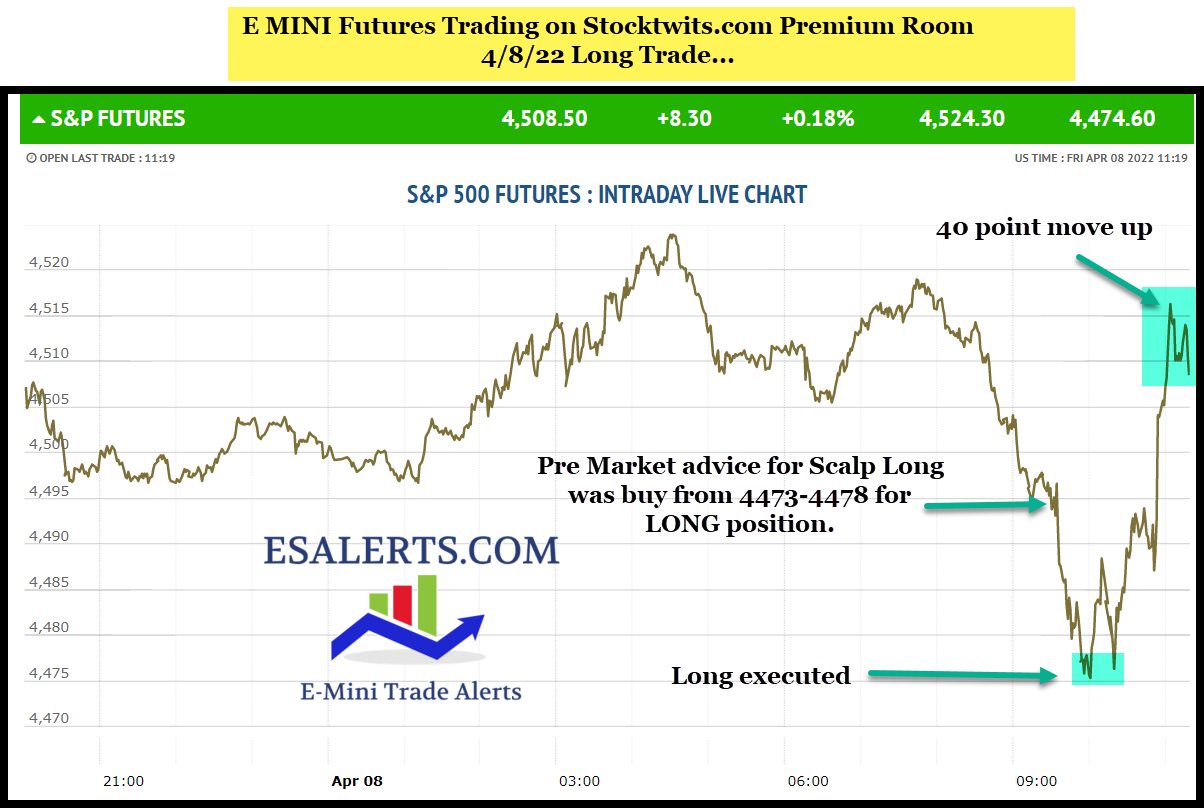

April 8th 2022 sample ES Long trade: Advised at 4495 pre market to wait to enter long at 4473-4478 ranges. We hit 4475 and went long, 40 point move up shortly thereafter. All of my market maps and trade alerts are based on my recipe for human behavioral patterns after 20 years of working in this area.

Micro Mini Trading of ES Futures-

Suggested minimum account size is $5,000 for Micro Mini’s, preferably $10,000 plus.

If just starting , I suggest trading 1 Micro contract per $5,000 of equity in an account. This allows scaling in and scaling out of positions using swing trading tactics deployed in our others services (3x ETF and Stock Trading).

Sample 11/5/2021, SP 5oo at 4700 $5x 4,700 is $2,350 contract size per Micro Mini

1 Micro Mini is $5 per SP 500 point movement. Each 1 point move in SP 500 is $5. If we have a 30 point move in our favor its $150 of gain or near 7% profit as of Nov 2021 numbers.

Micro E-Mini based accounts ($5 per 1 point move in SP 500) best for smaller sized accounts.

Sample if SP 500 is at 5000 each contract is $2,500 in value

At 1/10th the size of a classic E-mini contract, Micro E-mini futures give all traders a simple, cost-efficient way to access the liquid equity index futures markets. Each 1 point move in the SP 500 is a $5 move in the Micro E-Mini.

Tax Favorable treatment on trades combines Short Term and Long Term Capital gains rates for a blended rate of around 19%. (60% taxed at Capital Gains rate and 40% at Ordinary Income rates)

Sample Trade 2/18/20-2/19/20

Questions?

Email to Reversaltraders@gmail.com

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17-Peter Brandt, CEO, Factor LLC #10 2017 Twitter Favorite Traders Poll

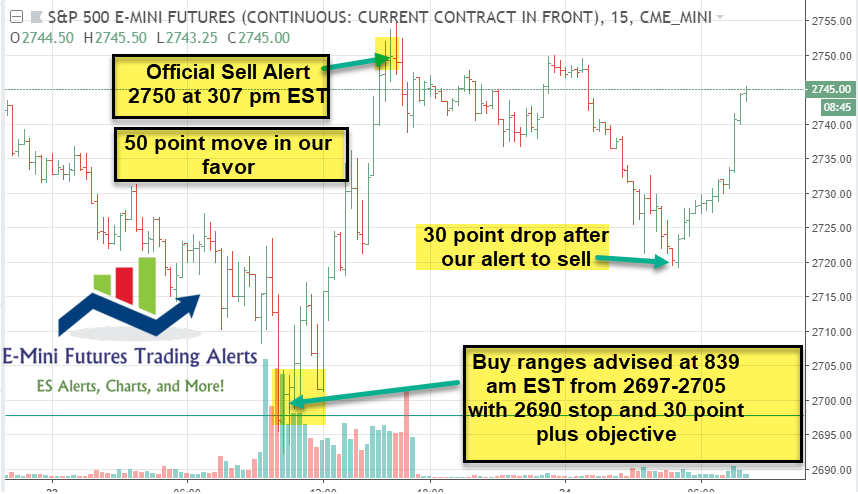

Sample Trades Stocktwits.com (Closed in January 2024 moved to new platform)

Here is a sample 50 point gainer from our futures service on Stocktwits: (Self Trade on your own)

Our Chief Strategist and Founder of The Market Analysts Group- Dave Banister 60

TheMarketAnalysts.com

Dave has been a featured writer and guest on TheStreet.com regarding Gold forecasting with Alix Steele. Also on CBSMarketwatch.com with Thom Calandra in the early 2000’s covering small cap stocks. He also has contributed to Kitco.com, been quoted on Bloomberg, and is a Seeking Alpha certified contributor as well as an author of articles at multiple investor websites. He is also followed by over 60,000 subscribers on Stocktwits.com under the username @stockreversals and its a suggested follow on that website.